How Much Money Should I Start With On Suretrader

Attempting to detect an online broker that meets your needs tin can be a daunting task, non to the lowest degree because at that place are and then many trading platforms operating in the online space.

If yous're looking for a broker that facilitates stocks – both large and small, options and ETFs, and then it might be worth taking a await at SureTrader. Almost notably, the platform appeals to those based in the U.Due south. that desire to avoid the earth-shaking 'Pattern Day Trader' rules.

In our SureTrader review, we'll cover everything that you need to know about the broker. This volition include the types of assets that yous can trade, fees, regulatory condition, client support and more.

By the cease of reading our SureTrader review from showtime to terminate, you'll exist equipped with all of the necessary tools to ascertain whether or not they're the correct banker for you.

Permit'due south start by finding out who SureTrader actually is.

Visit SureTrader

Who is SureTrader and What do They do?

Contents

- ane Who is SureTrader and What do They do?

- 2 What is Pattern Twenty-four hour period Trading?

- 3 What is a Margin Business relationship? How Does Margin Trading Work?

- 4 Pattern Day Trader Rule: Consider SureTrader

- 5 What Assets can you buy and Sell at SureTrader?

- vi Stocks and Shares (Equities)

- 7 Options

- eight ETFs

- ix SureTrader Fees: What Trading Fees exercise SureTrader Charge?

- 10 Standard Trading Fees for Stocks, Options and ETFs

- 11 Other Fees to Consider

- 12 Payments, Deposits and Withdrawals at SureTrader

- 13 SureTrader Deposits

- 14 SureTrader Withdrawals

- 15 Is SureTrader Safe?

- xvi Regulation

- 17 Account Security

- 18 What is Customer Support Like at SureTrader?

- 19 Educational, Key and Technical Analysis Tools at SureTrader

- 20 Research tools

- 21 How to become Started With SureTrader

- 22 SureTrader Review: The Verdict?

- 23 SureTrader

- 23.1 Ease of Use

- 23.2 Fees

- 23.3 Reputation

- 23.4 Customer Back up

- 23.5 Blueprint

- 24 Pros

- 25 Cons

In a nutshell, SureTrader is an online broker that allows people to merchandise financial assets from the condolement of their ain domicile. The platform are based in the Bahamas and thus, are not restrained by the aforementioned level of regulatory burdens as brokers based in the U.Due south. In terms of what yous can trade at SureTrader, this mainly centres on iii main asset classes.

Notably, this covers stocks and shares (including companies operating on the Pink Sheets), Options and ETFs. In terms of regulation, SureTrader are fully licensed by the Securities Commission of the Bahama islands, and are authorized by the Commutation Control, which is Regulated past The Key Bank of Bahamas.

Information technology should be noted that overall, the SureTrader platform is best suited to those with avant-garde cognition of online trading. This is because the platform offers a full range of advanced trading tools that in reality, might intimidate novice traders. All the same, to get the total suite of technical tools, you'll need to pay a monthly fee of $49.

Moreover, the SureTrader platform also places a strong emphasis on the availability of leverage. Again, this is something that is best avoided by those who are at the very beginning of their trading journeying.

Autonomously from offering highly competitive trading fees, 1 of the main selling points of Suretrader is that they effectively let U.S. citizens to bypass the Blueprint Day Trader rules fix by the Securities and Exchange Commission. In fact, they are quite open about this and thus, appeal to a very specific niche of the online trading infinite.

Although nosotros will cover the this in the next section, the Design Day Trader rule restricts day trading activities for U.S. citizens if individuals do non hold a minimum equity residue of at least $25,000.

As this is a major do good for a lot of traders based in the U.S., our SureTrader review will explore the Pattern Day Trader phenomena in more detail below.

What is Design Solar day Trading?

The term 'Design 24-hour interval Trader' is a regulatory term that was created to describe a specific type of trader. In its most bones class, if an private executes four or more day trades within a v day period, then in the eyes of U.Southward. regulators they are a Pattern Day Trader. So why does this matter?

Well, information technology'south all surrounding the risks associated with margin accounts.

As the Pattern Day Trader rule is of utmost importance for U.S. citizens, alongside the fact that this is i of SureTrader's strongest selling points, information technology is crucial that we briefly explain what this means.

What is a Margin Account? How Does Margin Trading Work?

Margin trading, or trading on margin, are terms used to describe the act of investing more than than you actually have in your brokerage account. In other words, you're essentially borrowing money from the broker in question, to trade larger amounts.

Margin accounts are completely separate from standard cash accounts, every bit you're finer trading funds that have been loaned to you lot from the broker. In the vast majority of cases, broker's require an initial eolith to facilitate margin trading.

The amounts that you are able to trade on margin will unremarkably depend on the corporeality of funds you lot deposit in to your margin account. Take note, if the markets do not movement in your favor, the banker is probable to ask y'all to deposit additional funds in to your margin account. Otherwise, you face the risk of having some of your invested assets sold on your behalf, in order to cover the shortfall.

Information technology is this specific form of trading that links directly to the Pattern 24-hour interval Trader rule.

Pattern Day Trader Rule: Consider SureTrader

If you're based in the U.S., then you'll know full-well how stringent regulation is with respect to financial securities. Co-ordinate to the Financial Industry Regulatory Authority (FINRA), for a trade to autumn within the remit of Blueprint Day Trading, the security must be bought and sold on the aforementioned day, via a margin account.

As such, should you execute 4 or more than of these trades within five business days, y'all'll demand to follow the Pattern Day Trader rule.

Ultimately, this means that you will need to hold a minimum margin balance of at least $25,000.

it is of import to note that the minimum balance of $25,000 can be made up of both cash and eligible securities. However, if the realizable value of the assets in your margin account does fall below $25,000, and so you volition exist restricted from making any further trades until the amount is topped upwards.

These rules are a pregnant hindrance for those that desire to trade on margin, but are unable to meet the requirements ready out past both the SEC and FINRA.

As such, the SureTrader platform opens the doors for Pattern Twenty-four hour period Traders, not least because they are non bound by the same rules.

Then now that you know what Mean solar day Pattern Trading is, and why this is a huge selling for betoken for SureTrader, in the next part of our SureTrader review we are going to explore what assets you lot tin can merchandise.

What Assets tin you purchase and Sell at SureTrader?

When it comes to the amount of assets available at SureTrader, the banker focuses exclusively on three main instruments. This includes traditional stocks, options and ETFs.

While this might sound somewhat thin, taking into account the fact the banker does not offer mutual funds, futures, bonds or forex, in reality there are more x,000 assets available to trade.

Allow's suspension these downward in more than particular below.

Stocks and Shares (Equities)

Our SureTrader review constitute that the platform lists more than than x,000 equities, which is very impressive. This covers the main stock markets, such as the New York Stock Exchange (NYSE) and NASDAQ, meaning yous'll be able to speculate on the largest companies in the world.

Not only this, just SureTrader is one of the merely online trading platforms that allows you to invest in penny stocks. As penny stocks almost commonly operate in the OTC (Over-the-Counter) markets, trading is primarily reserved for brokers that have access to the likes of the Pink Sheets. Equally such, yous'll demand to go with a specialist banker to get a look in.

On the contrary, y'all can speculate on penny stocks directly from your SureTrader business relationship.

However, it is of utmost importance that you empathize no matter what type of stock you lot buy, you are actually investing in CFDs (Contract-for-Differences). This means that although you can speculate on the value of the underlying asset, you do not really own it. This too means that yous won't be accustomed to dividend payments.

Nonetheless, ane of the great benefits well-nigh CFDs is that you can also 'Go Curt' on stocks. In other words, you can speculate on the value of the stock going downward, rather than upward.

Options

If you're a more experienced trader and have a full grasp of how options piece of work, then SureTrader can facilitate this for you. You'll be able to trade options across more than 10,000 equities, subsequently giving you the opportunity to create a big portfolio of assets.

ETFs

The tertiary and concluding nugget form that SureTrader facilitate is that of ETFs. Exchange Traded Funds, nigh commonly referred to every bit ETFs, track central marketplaces such as the NASDAQ, Gold, Oil or even real estate.

As an investor, you'll be able to speculate on a group of avails (such as the Southward&P 500) via a single trade, rather than having to make multiple trades.

So now that we've explored what assets you can merchandise at the broker, in the next role of our SureTrader review we are going to explore trading fees.

SureTrader Fees: What Trading Fees exercise SureTrader Charge?

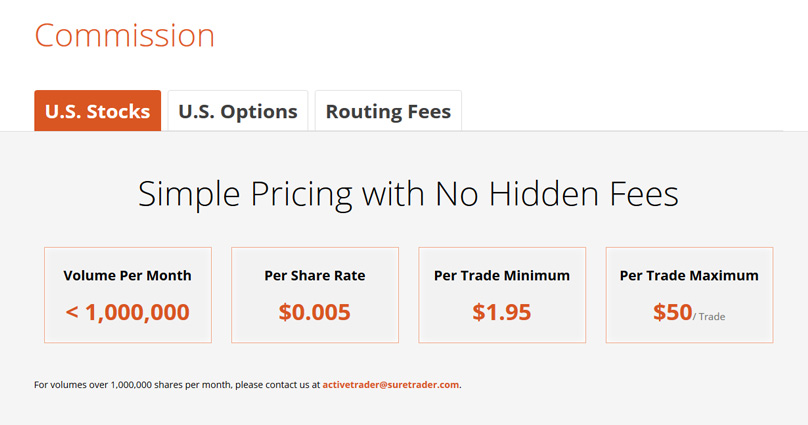

When it comes to trading fees at SureTrader, the platform has one of the most competitive pricing structures in the online brokerage infinite. The banker rewards investors that merchandise larger volumes.

Standard Trading Fees for Stocks, Options and ETFs

The standing trading fees for stocks and shares at SureTrader are $4.95/per merchandise. On top of this, yous'll likewise need to pay $0.ten for each share you concord.

If you are an agile investor and manage to merchandise more $250,000 in a single month, then you'll get this downwards to $3.95/per trade plus $0.008 for each share.

Moving up the activity scale, trades between $500,000-$750,000 and $750,001-$i,000,000 attract reduced trading fees of $2.95 ($0.006 for each share) and $1.99 ($0.004 for each share).

Ultimately, while these trading reductions are highly competitive, you lot need to be trading some serious amounts to get anywhere shut.

Trading fees with respect to options are much less complex, and corporeality to a flat fee of $4.95, plus $0.50 for each contract.

When information technology comes to trading ETFs, this follows the same pricing structure every bit stocks and shares.

Other Fees to Consider

Outside of the standard trading fee construction offered by SureTrader, there are some investment-based fees that you demand to be made aware of. In lodge to make this clearer for you, nosotros've listed the virtually pertinent charges below.

- If you lot concur margin positions overnight, this is charged at a reasonable Apr toll of 7.five%

- If y'all're shorting stocks and holding the position overnight, this is charged at 0.5%

- You lot'll pay an additional $25 per merchandise for margin calls

- If you practice execute more than than xv trades across a 3-month menstruum, an inactivity fee of $50 applies

So now that we've covered trading fees, in the side by side part of our SureTrader review we are going to await at deposits and withdrawals.

Payments, Deposits and Withdrawals at SureTrader

When it comes to funding your business relationship, our SureTrader review establish that you have a few options to choose from.

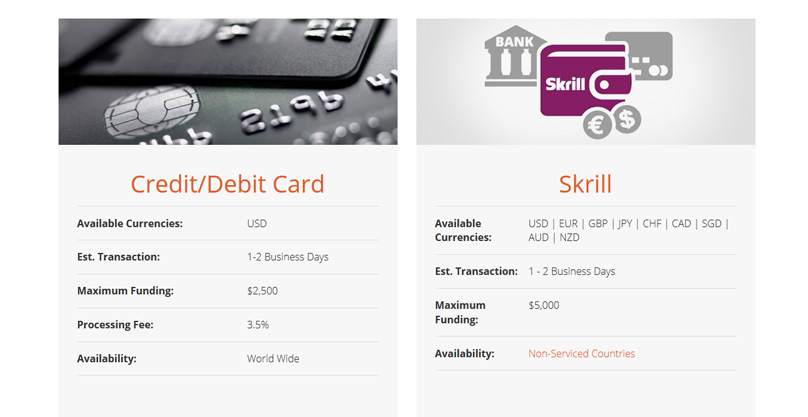

SureTrader Deposits

Most people prefer to use a debit card, as it's super user-friendly and funds are credited instantly. Interestingly, SureTrader besides allow you to fund your account with a credit card.

This is highly unusual, as the vast majority of brokers operating in the online space do not commonly permit credit cards to be used. Take annotation, regardless of whether you lot are using a debit or credit card, you lot volition take to pay a 3.50% processing fee.

This is really very high, not least considering you volition need to make at least 3.50% in trading profits just to cover the deposit. We should also notation that SureTrader does not take the ability to process Canadian debit/credit cards.

A somewhat unconventional deposit method that SureTrader as well back up is that of e-wallets. You have the capacity to deposit upwards to $5,000 via Skrill or Neteller, and supported currencies includes USD, EUR, GBP, JPY, CHF, CAD, SGD, AUD, & NZD. The official deposit timeframe is betwixt 1-24 hours.

However, much like in the case of debit and credit carte du jour deposits, fees are extortionate. You'll pay a remarkable 3.ninety% in processing fees, plus a fixed token payment of €0.35. Moreover, we should also note that Skrill payments are not open to U.Due south. residents.

If you lot want to cut down on the eolith fees, then your best option is fund your business relationship via the ACH (Automated Clearing House) or a traditional depository financial institution wire. These two deposit methods are the only payment mechanisms listed on the SureTrader website that exercise not display processing fees. As such, information technology is probable that the just processing fees y'all will pay are those initiated by your fiscal institutions.

On the other hand, ACH/bank wire payments are by far the slowest, and may take upwardly to 5 working days before they hit your SureTrader account.

No matter what funding method you opt for, minimum deposits corporeality to $500.

Now permit's take a look at withdrawals.

SureTrader Withdrawals

When it comes to withdrawing funds out of your SureTrader account, there are a few things to consider. Firstly, if y'all want to withdraw funds via a wire transfer, due east-wallet (both Skrill and Neteller) or ACH, you'll pay a flat fee of $40.

If yous desire to withdraw back to either a debit or credit card, this will attract a iii.5% processing fee. As such, by depositing and withdrawing by debit/credit card at the broker, our SureTrader review plant that you'll pay an end-to-end fee of vii%.

Alternatively, and perhaps the best option, is to obtain the SureTrader MasterCard. This is essentially a prepaid debit bill of fare that allows you to transfer your SureTrader funds across.

As the card is backed by MasterCard, not only can you lot withdraw funds via an ATM, but you tin as well apply it anywhere that MasterCard is accustomed.

So now that we've covered the eolith and withdrawal procedure, in the next section of our SureTrader review we are going to explore whether your funds are condom at the broker.

Is SureTrader Safe?

This part of our SureTrader review is potentially the most of import. When reviewing stock brokers that are based in the U.Due south., nether normal circumstances y'all can be confident that the banker is heavily regulated, not least because there is a highly stringent regulatory framework that covers investment platforms of all sizes.

However, as SureTrader is in fact located in the Bahama islands, we need to have a closer look at this.

Regulation

Launched in 2008, the SureTrader platform is regulated by the Securities Commission of the Bahamas. It is this organization who are responsible for ensuring that SureTrader proceed client funds safe.

It is rubber to say that the Securities Commission of the Bahamas are nowhere near every bit thorough as the SEC, and thus it is hard to say with any certainty how condom the broker is.

What nosotros can point towards is the fact that SureTrader has an established trading history that dates back to 2008. As per a thorough evaluation of reviews and comments available within the public domain, at that place appears to be no major indicators that the banker are annihilation but legitimate.

On meridian of this, the SureTrader platform too has a regulatory oversight from the Primal Banking concern of the Bahamas, who human activity as the Controller of Exchange for all trading platforms operating inside the nation.

In layman terms, this means that because the Central Bank are members of the International Monetary Fund, they themselves must ensure that they operate in a highly stringent style.

All in, although you tin can never be 100% sure with online brokers, no matter where they are based, we see no reason to exist overly cautious with SureTrader, non least considering the general consensus is that they do everything by the volume.

Business relationship Security

In terms of account security, it appears that SureTrader do not offer users traditional login safeguards such as two-gene authentication (2FA). On the other hand, the platform does employ Secure Socket Layer (SSL), which is manufacture standard for the online broker space.

This means that your personal data is encrypted, and thus, keeps your data prophylactic from potential bad actors.

And then now that we've covered regulation and account security, in the next department of our SureTrader review nosotros are going to see what the platform'south client support is like.

What is Customer Support Like at SureTrader?

Before contacting customer support, information technology is worth noting that the SureTrader platform has an excellent knowledge base of operations. When we explored this ourselves, we found that well-nigh account queries can be resolved through the extensive FAQ department.

Still, if you need to speak with a client back up agent, y'all have a few options bachelor to choose from.

The support team tin exist contacted via telephone, which offers services numbers from the U.S., Canada, the UK and Australia. Alternatively, yous can also contact SureTrader via their alive chat facility.

Information technology appears that this is not on a 24/7 basis, as on one occasion the alive chat pick was not available for us.

Y'all tin can likewise contact the support team via a back up ticket, electronic mail and even Skype.

Although the platform offers a broad variety of support options, public stance is somewhat separate. While some users claim that customer support is nothing short of top-notch at SureTrader, there are also a number of negative reviews besides.

And so at present that nosotros've covered customer support, let'southward take a look at what educational and inquiry tools are available at the broker.

Educational, Fundamental and Technical Analysis Tools at SureTrader

Although we are under the impression that the SureTrader platform is potentially best suited to more advanced traders, the banker does provide a skilful range of educational materials for less experienced investors.

This includes a fully-fledged blog that contains educational guides for newbies. This covers topics such as 'The deviation betwixt options and futures', 'Trading strategies for beginners' and 'Solar day trading vs long-term trading'.

On tiptop of the educational hub, SureTrader also offering a comprehensive trading simulator. This is where yous become to exam-out the platform without risking your own funds.

Although this can be useful for those with little experience, demo accounts are ofttimes limited in their effectiveness. The central reason for this is that until y'all risk your own money, you lot won't go a grasp of the emotional side of trading.

Research tools

Regardless of how experienced you lot are in the trading sphere, all investors require tertiary political party sources to assay the potentialities of the nugget they want to speculate in.

If you're the type of trader that relies heavily on technical analysis, then it is worth because the SureTrader Desktop platform. Although this costs $49 per month, you'll have admission to a full suite of trading tools. Alternatively, the free department is somewhat limited.

In terms of the fundamentals – which refers to real-world developments that can bear upon the value of an asset, unfortunately this isn't something that you can readily access at SureTrader.

Although there is a dedicated news section, this is rarely updated. As such, although a slight hindrance, you lot'll demand to perform central evaluations from culling sources.

So now that nosotros've covered educational and enquiry tools, in the next department of our guide we are going to testify you how to get started at SureTrader.

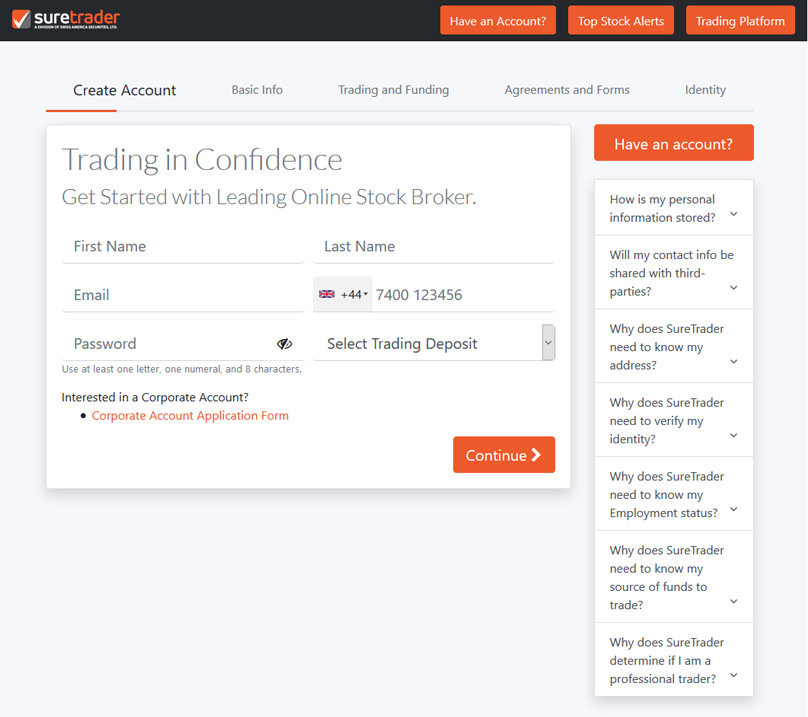

How to get Started With SureTrader

If you think that SureTrader is the right online broker for your private needs, then we will prove you how you can get started. Follow our unproblematic step-by-step instructions to open an business relationship.

- Head over to the SureTrader platform To go the business relationship opening procedure under style, head over to the SureTrader platform. To make things easier for you lot, simply click here .Once there, click on Open an Business relationship.

- Enter some bones information In the first part of the application process, you'll need to enter some basic information. Enter your full legal name, email address and phone number.

- Choose what type of investor yous are Although not as stringent as other online brokers, you'll still need to confirm what type of investor yous are. If you're merely trading on an individual basis, then select Individual.In the side by side section, you lot'll then need to enter more data, such every bit your country of residence and date of nascence. Moreover, y'all also need to specify what sort of trading y'all'll exist undertaking.

The options are as follows:* Short-term returns * Boosted revenue * Saving for investment * Time to come planning (retirement etc.) - Insert details about your risk tolerance and source of funds Although SureTrader are regulated outside of the U.South., the platform still has regulatory obligations with respect to risk tolerance. In other words, they have to make certain that you have a full grasp of the underlying risks of trading online.Go through the list of questions and reply them to best of your abilities. SureTrader only need approximations, so don't worry if your risk tolerance changes at a afterwards appointment. Inside the same page yous'll also need to ostend where your source of trading funds have originated from.

- Confirm your wealth levels As is industry standard in the online brokerage space, you'll likewise need to provide SureTrader with your current wealth levels. This covers your annual income, net worth and liquid net worth. Moreover, if y'all're currently employed, you'll demand to enter the details of your current employer.

- Tax form W8 submission If y'all're based in the U.South., or a U.S. citizen living abroad, and then you lot'll need to make full out your W8 revenue enhancement grade. This is a legal requirement, no matter which online broker you use. Make certain the details that y'all enter are right, otherwise you might take experience bug with the IRS further down the line.

- Upload copies of your ID and proof of address You'll now need to upload a copy of a government issued ID (such as a passport) and a proof of accost certificate (such as a utility beak).

- Look for your account to be verified Now that you've gone through the end-to-finish account opening process, the squad at SureTrader will now brainstorm verifying your information.Although SureTrader advise that this is likely to have between 2-5 business days, in most cases it is much sooner. Nevertheless, equally shortly as you lot receive an email confirming that your business relationship has been opened, you'll exist able to make a deposit and brainstorm trading.

SureTrader Review: The Verdict?

In summary, we retrieve that the SureTrader platform is best suited to a specific type of trader. If yous've got some trading experience under your belt, then they might well be the broker for you.

More specifically, if yous're an active trader based in the U.S., or a U.Due south. citizen living overseas, then you'll be able to bypass the Pattern Solar day Trader rules that crave you to hold a minimum margin balance of $25,000.

In terms of fees, our SureTrader review constitute that a apartment fee of $4.95 (plus $0.x per share) is highly reasonable for disinterestedness trading. Although the fees continue to decline when you trade larger volumes, you'll demand to turnover at least $250,000 per month to be eligible. Nevertheless, if you lot practise merchandise serious amounts, you can become your per trade fee down to just $1.99 ($0.004 for each share).

When information technology comes to regulation, although the broker is based in the Bahamas, they are withal in full receipt of the required licenses to offer their services, including those from the U.South. Moreover, as SureTrader have been in operation since 2008, they accept built up a good for you reputation from the online community.

In terms of the negatives, we were slightly disappointed with the lack of availability regarding futures, mutual funds and forex trading, although with more than x,000 assets hosted, there's enough of securities to choose from.

Finally, it is a slight shame that the platform does not put more emphasis in to their research analysis department, although it tin can only exist hoped that this is something SureTrader are working on.

Visit SureTrader

SureTrader

Pros

- No pattern mean solar day trading rules

- Low Minimum Eolith $500

- Easy to Use Trading Software

- Margin Trading

- Expert Charting Tools

Cons

- $l inactivity fee quarterly for accounts with less than 15 trades

- $forty fee for approachable funds

- Defective some avails to trade

iii,098

Source: https://moneycheck.com/suretrader-review/

Posted by: schroederjace1953.blogspot.com

0 Response to "How Much Money Should I Start With On Suretrader"

Post a Comment